When documenting storm damage for insurance claims, we should start by evaluating immediate safety and evacuate if necessary. We photograph and record detailed videos of the damage, ensuring each is timestamped and includes landmarks. Creating an itemized inventory of all damaged items with serial numbers and descriptions is essential. Saving and categorizing repair receipts, noting weather conditions, and digital storage of all documentation keeps things organized. Contacting our insurance promptly, initiating a policy review, and understanding coverage limits streamline the claim process. Tracking communications and obtaining professional estimates further support our claim. Learn more detailed steps ahead.

Key Points

- Photograph the Damage: Capture wide-angle and close-up shots from multiple angles, including recognizable landmarks, and ensure all photos are timestamped.

- Record Detailed Videos: Narrate while recording steady, slow videos from various perspectives to provide comprehensive evidence of storm damage.

- List All Damaged Items: Create a detailed inventory categorized by type and extent of damage, supported by photos and purchase records.

- Capture Serial Numbers: Photograph and document serial numbers with descriptions and purchase details to strengthen proof of ownership.

Assess Immediate Safety

Our first priority after a storm is to assess immediate safety by looking for hazards such as downed power lines, gas leaks, and structural damage. We need to be thorough and methodical in our approach. Safety precautions are essential; always assume power lines are live and avoid any contact.

If we detect the smell of gas, it's vital to evacuate the area immediately and contact emergency services. Structural assessment should include checking for visible cracks, leaning walls, and weakened foundations. These could indicate significant damage that mightn't be apparent at first glance.

Identifying hazards quickly can prevent accidents and further injuries. We should also be aware of any emergency contacts we might need, such as local utility companies and emergency responders. Having these numbers readily available can expedite help and guarantee that professionals handle dangerous situations.

When we conduct a structural assessment, we're looking for signs of compromised integrity. This includes inspecting the roof, windows, and doors for any breaches or failures. By systematically identifying potential hazards, we secure our safety and prepare for the next steps in documenting storm damage for insurance claims.

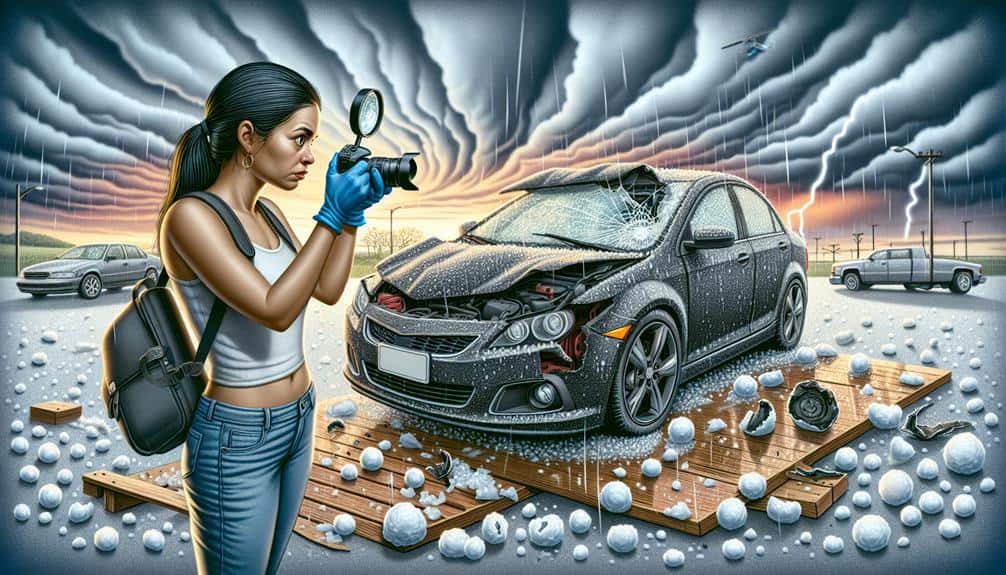

Photograph the Damage

Often, capturing clear and detailed photographs of the damage is crucial for substantiating our insurance claims. To effectively document damage, we should start by taking wide-angle shots of the entire affected area. This offers a thorough overview, showing the extent and context of the damage.

Next, we focus on close-up images of specific damages. These detailed photos serve as vital visual evidence that can support our claim validation process. It's crucial to capture various angles of the same damage to provide a full perspective, making sure nothing is left unclear. If possible, include recognizable landmarks or elements in the frame to anchor the images to a specific location. This aids in corroborating our damage documentation with the insurance company's records.

Additionally, we shouldn't forget to timestamp our photographs. Many digital cameras and smartphones have this feature, which can be invaluable in proving when the damage occurred. This chronological evidence strengthens our insurance claims, providing a clear timeline of events.

Remember to document both exterior and interior damages, such as roof leaks or broken windows, to guarantee a thorough claim. By meticulously photographing the damage, we strengthen our position, making our claim more robust and credible.

Record Detailed Videos

Recording detailed videos offers an additional layer of documentation that can greatly enhance our insurance claims. By capturing video evidence, we provide a more thorough view of the storm damage, which can be vital during the claim process. Videos allow us to showcase the extent of the damage from multiple perspectives, highlighting areas that static photos might overlook. This dynamic form of documentation can greatly enhance the accuracy of our claims, offering insurers a clear and indisputable record of the storm's impact.

To maximize the effectiveness of our video evidence, we should narrate as we record. This narration provides context, such as the date, time, and specific details of the damage, which can be essential for insurance coverage evaluations. For example, pointing out water damage, broken windows, or roof issues helps establish a clear link between the storm and the resulting damage.

Additionally, keeping the camera steady and walking slowly ensures that we capture high-quality footage, which can be examined in detail later.

List All Damaged Items

To guarantee a thorough insurance claim, we need to create a detailed inventory of all affected items, including capturing serial numbers where applicable.

By categorizing items based on the type and extent of damage, we'll make it easier for the insurance adjuster to assess the situation accurately.

This systematic approach will help expedite the claims process and secure we receive the appropriate compensation.

Inventory of Affected Items

An accurate inventory of all damaged items is essential for ensuring a thorough insurance claim. We need to list every affected item meticulously, noting the extent of the damage and any relevant details. This step allows us to present a detailed case to our insurance company, maximizing the likelihood of a fair settlement.

First, let's systematically review each room and outdoor area to identify affected items. We should document each item individually, including descriptions, conditions, and any pre-existing issues. Using a spreadsheet can help us organize this information efficiently, making it easier to track expenses and manage repairs.

Next, we'll take detailed photographs or videos of each damaged item. Visual evidence supports our written descriptions and helps the insurance adjuster understand the damage's scope. Along with photos, receipts, and purchase records are invaluable for proving the item's original value and facilitating the replacement process.

Capture Serial Numbers

In addition to documenting the damage, we need to capture the serial numbers of all affected items to provide precise identification for our insurance claim. Serial numbers serve as unique identifiers, making it easier for insurance companies to verify each item. This step is crucial in proving that we owned the damaged items and ensuring that our insurance coverage accurately reflects the losses we've incurred.

First, let's locate the serial numbers on all damaged goods. Typically, these are found on the back or bottom of electronic devices, appliances, and other high-value items. We should photograph each serial number clearly and make sure that the item it's attached to is also visible in the same frame. This visual evidence strengthens our proof of ownership and helps avoid disputes during the claims process.

Next, creating a detailed list is essential. For each item, record the serial number along with a brief description, the date of purchase, and the original cost if available. This comprehensive documentation will expedite the insurance claim process by providing a clear, organized reference for the adjuster.

Categorize by Damage Type

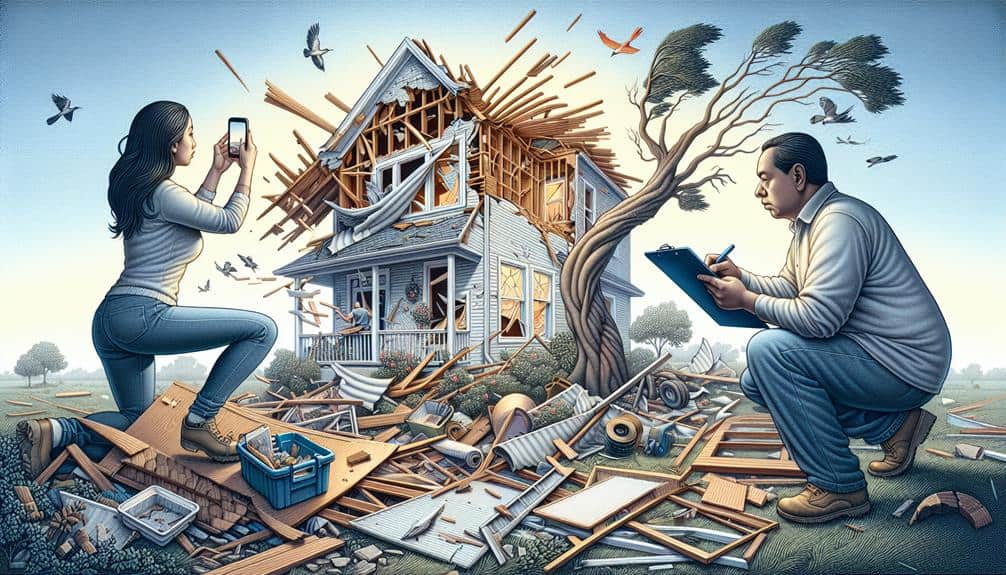

Let's systematically categorize all damaged items by the type of damage they've sustained to streamline our insurance claim process. This approach not only organizes our efforts but also guarantees we capture every detail necessary for a successful claim.

First, we'll focus on roof leaks and water damage. Identify areas where the roof has been compromised. Document any visible leaks, stains, or structural weaknesses. Note the affected rooms and the extent of the water damage. Include details about damaged insulation, ceilings, walls, and flooring. Take clear photos and record videos to substantiate our claims.

Next, assess the impact of fallen trees and property destruction. Identify any trees that have fallen on structures, vehicles, or other property. Document the damage thoroughly, noting both the tree's condition and the affected structures. Include measurements and descriptions of any destroyed fences, sheds, or other exterior elements.

Save Repair Receipts

Keeping all repair receipts meticulously organized is vital for substantiating your insurance claim. When we organize receipts and track expenses, we provide clear evidence of the costs incurred due to storm damage. This not only makes it easier for us to present our case to the insurance adjuster but also guarantees that we don't overlook any reimbursable expenses.

Documenting repairs and verifying costs are crucial steps in this process. By saving every receipt related to storm damage repairs, we create a detailed record that can be referred to when needed.

Here's how to approach it:

- Categorize Receipts: Group receipts based on the type of repair or purchase. This helps in quickly identifying and referencing specific expenses.

- Track All Expenses: Maintain a spreadsheet or use software to log each expense. Include details like the date, vendor, description of the repair, and cost.

- Store Digitally: Scan or photograph receipts and store them in a cloud service. This ensures they're secure from further damage and easily accessible.

Note Weather Conditions

Accurately noting weather conditions during and after a storm provides essential context for your insurance claim. By documenting these details, we can strengthen our case and expedite the claims process. It's essential to record the exact time and date of the storm, as well as any specific weather patterns observed, such as heavy rainfall, strong winds, hail, or lightning. This information helps verify the timing and severity of the storm, which can be pivotal in supporting our claims.

Let's also pay attention to emergency response alerts or warnings issued during the storm. These can serve as additional evidence of the storm's intensity and the immediate need for protective actions. We should keep track of any local news reports, weather advisories, or emergency notifications we receive. Screenshots, printouts, or saved videos of these alerts can further substantiate our claims.

Contact Your Insurance

The first step in starting our insurance claim process is to promptly contact our insurance provider to report the storm damage. This timely action ensures that we begin the process of policy review and claim submission without delay. By doing so, we can efficiently move forward with evaluating our coverage limits and obtaining necessary deductible clarification.

When reaching out to our insurance provider, we should have essential information at hand to facilitate the discussion. Here are three vital steps to follow:

- Policy Review: Before making the call, let's thoroughly review our insurance policy. Understanding the specifics of our coverage will help us ask informed questions and identify what damages are covered.

- Claim Submission: During the call, we'll need to provide detailed information about the damage. This includes dates, descriptions, and any preliminary assessments we've made. Clear communication will expedite the claim submission process.

- Coverage Limits & Deductible Clarification: It's important to clarify our coverage limits and understand the deductible we're responsible for. This knowledge will help us set realistic expectations for the claim's outcome.

Get Professional Estimates

To make sure we receive a fair assessment of the storm damage, let's obtain professional estimates from qualified contractors. This step is important to make sure that our insurance claims reflect the actual cost of repairs. By hiring experts, we can be confident that the estimates we receive are thorough and accurate, covering all aspects of the damage.

First, we should research and identify reputable contractors with experience in storm damage repairs. We can start by asking for recommendations from friends, family, or neighbors who've faced similar situations. Online reviews and ratings can also help us narrow down our options.

Once we've identified potential contractors, let's schedule appointments for them to inspect the damage. It's vital to obtain multiple estimates so that we can compare quotes. By doing this, we can identify any differences and make sure that we aren't overpaying for repairs. Additionally, having multiple quotes provides us with a stronger position when negotiating with our insurance company.

When we compare quotes, let's pay attention to the details each contractor includes. We should look for thorough assessments that cover both visible and hidden damages. This approach ensures that we receive the best possible settlement for our claim.

Keep Communication Records

Maintaining detailed records of all communications with our insurance company is necessary for ensuring a smooth claims process. We need to keep communication logs to track every conversation, email, or message exchanged. This meticulous documentation helps us stay organized and provides a clear trail of our interactions, which can be vital if any disputes arise regarding our insurance claims.

Effective documentation organization involves recording dates, times, the names of representatives, and the content of each discussion. By doing this, we can easily reference past communications and verify any agreements or instructions given by the insurance company.

Here are three key steps to maintain thorough communication records:

- Create a Log: Use a notebook or a digital tool to record every interaction. Include details such as the date, time, representative's name, and the main points discussed.

- Save Emails and Messages: Keep copies of all emails and messages in a dedicated folder, either physical or digital, for easy retrieval.

- Document Phone Calls: After each phone call, write a summary of the conversation and any commitments made by either party.

Store Documentation Securely

Storing our documentation securely is crucial for safeguarding important information and guaranteeing it remains accessible throughout the insurance claim process. Let's explore how we can achieve this using modern technology and best practices.

First, employing encryption methods is indispensable. By encrypting our files, we protect sensitive data from unauthorized access. Encryption guarantees that even if someone gains access to our files, they won't be able to read them without the decryption key. Cloud storage platforms often provide encryption services, making them a viable option for securely storing our documentation.

Next, using cloud storage offers the benefit of accessibility. We can retrieve our documents from any device with internet access, which is particularly useful in the aftermath of a storm. Additionally, reputable cloud services offer robust security measures, including encryption and regular data backups.

Password protection is another crucial layer of security. By using strong, unique passwords for our cloud storage accounts and any external hard drives, we further safeguard our information. It's important to update passwords regularly and enable two-factor authentication where possible.

Lastly, external hard drives provide a secure offline backup. By storing copies of our documentation on encrypted external hard drives, we guarantee access even if internet services are disrupted. Combining these methods maximizes our data's security and accessibility.

Frequently Asked Questions

How Soon Should I Report Storm Damage to My Insurance Company?

We can't stress enough the importance of the reporting timeline. As soon as possible, let's document everything meticulously. Our documentation methods should be thorough, ensuring we capture every detail to support our claim efficiently.

Are There Specific Apps Recommended for Documenting Storm Damage?

For photo documentation and video evidence, we recommend apps like HomeZada and MyPropertyID. These apps help create detailed digital records, ensuring our documentation is thorough and easily accessible. They provide freedom through organized and efficient tracking.

Can I Start Repairs Before the Insurance Adjuster Visits?

Yes, we can start urgent repairs before the insurance adjuster visit, but documenting accuracy is essential. To avoid impacting claim approval, follow the repair timeline and guarantee thorough documentation for the insurance adjuster's review.

What if My Insurance Policy Doesn't Cover All the Damage?

Surprise, our policy doesn't cover everything! We'll need to start negotiating coverage with the insurer. Seeking assistance from a public adjuster or legal advisor might help us explore other options and assert our rights effectively.

How Can I Protect My Home From Future Storm Damage?

To protect our home from future storm damage, let's implement preventive measures and invest in home improvements like reinforcing roofs, installing storm shutters, and securing outdoor items. These actions enhance safety while preserving our freedom and peace of mind.