Let's document wind damage thoroughly to make sure our insurance claim is both accurate and compelling. We'll start with a detailed visual inspection of the property, noting obvious and subtle signs of damage. We should photograph the affected areas from multiple perspectives with clear, well-lit shots. Detailed written descriptions, including damage types and measurements, are essential. Gathering witness statements and organizing all documents—photos, receipts, estimates, and logs of interactions—will further strengthen our claim. By following these steps, we'll make sure our insurance adjuster has all the information needed to fairly assess the damage and our claim will be complete and strong.

Key Points

- Conduct a thorough visual inspection of the entire property, noting any signs of wind damage.

- Take clear and comprehensive photos from various angles, including close-ups of the most damaged areas.

- Record detailed descriptions of the damage, specifying the type, materials affected, and extent.

- Collect and document witness statements to provide firsthand accounts of the wind damage.

Assessing Initial Wind Damage

To begin evaluating initial wind harm, we need to conduct a thorough visual inspection of the entire property, noting any obvious signs of harm such as broken windows, missing shingles, or fallen branches. Our harm assessment should start by walking the perimeter of the property, paying close attention to the roof, siding, and any outbuildings.

As we proceed, we should look for subtle indicators of wind harm that mightn't be immediately apparent. These include displaced gutters, loose flashing, and harm to fences or exterior fixtures. This detailed property evaluation allows us to identify both major and minor damages that could impact our claim.

Inside the property, we should inspect ceilings and walls for water stains or cracks that may have resulted from roof harm. Checking around windows and doors for drafts or visible gaps is also essential. Each of these steps guarantees that we compile a detailed list of all affected areas.

Photographing Affected Areas

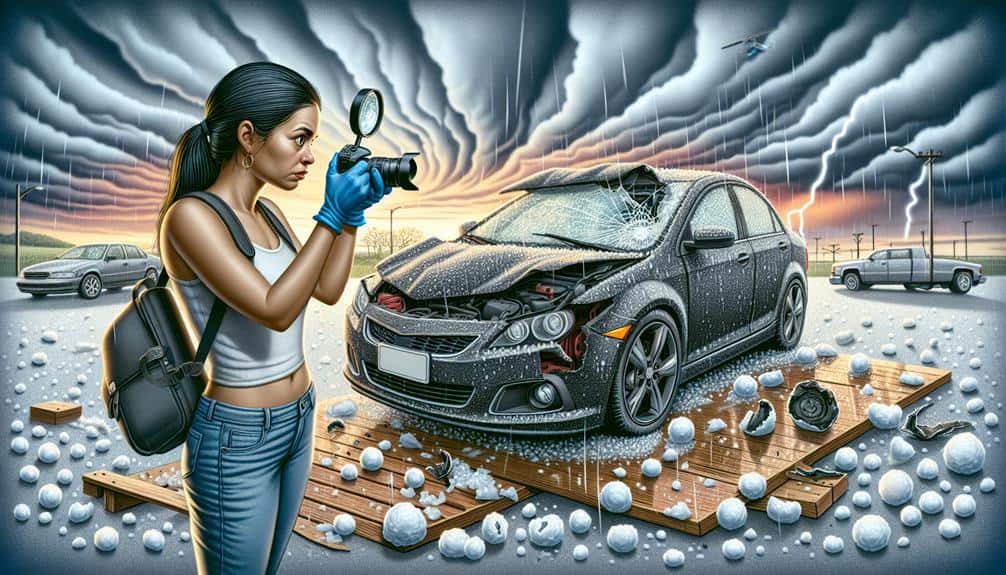

Capturing clear and thorough photographs of the affected areas is important for substantiating our insurance claim. We need to make sure that our photos are detailed and extensive, so the insurance adjuster can clearly understand the extent of the wind damage.

Here's how we can effectively document the damage:

- Angle variations: Take photos from different perspectives to provide a complete view. This helps showcase the damage from various angles, making it easier for the adjuster to assess the situation.

- Lighting considerations: Proper lighting is essential. Natural light is ideal, but if that's not possible, use a flashlight or other sources to illuminate the area. Avoid shadows and dark spots that might obscure details.

- Before and after shots: If we've photos of the property before the damage occurred, it's useful to include these. Contrasting before and after shots highlights the severity and specifics of the wind damage.

- Close-ups: Don't forget to take detailed close-up shots of the most damaged areas. This includes broken windows, damaged roofs, or any structural issues. Close-ups allow the adjuster to see the intricate details that wide shots might overlook.

Recording Detailed Descriptions

We need to carefully document each instance of wind damage with detailed descriptions to guarantee the insurance adjuster has a thorough understanding of the situation. Descriptive accuracy is vital. When we note the wind damage details, we should include specifics like the type of damage, the materials affected, and the extent of the destruction.

For example, instead of merely stating 'roof damaged,' we should describe it as 'shingles missing from the southeast corner of the roof, exposing the underlying wooden structure.'

Quantifying the damage is also essential. We should specify measurements, such as 'three feet of fence blown down' or 'two windows shattered on the west side.' Including these precise written descriptions ensures that the insurance adjuster can accurately assess the scope of the damage without making assumptions.

Additionally, we should mention any immediate safety hazards caused by the wind damage. Descriptions like 'broken tree branches hanging precariously over the garage' or 'debris scattered across the driveway, posing a tripping hazard' highlight urgent issues that need prompt attention.

Careful and detailed documentation helps us convey the full impact of the wind damage, safeguarding our freedom to receive fair compensation for repairs.

Collecting Witness Statements

Gathering witness statements provides important firsthand narratives that can greatly strengthen our insurance claim for wind damage. By interviewing witnesses who observed the event, we can collect valuable perspectives that corroborate our own observations and evidence.

Here's how we can effectively gather statements:

- Identify Witnesses: Look for neighbors, passersby, or anyone who might've seen the wind damage occur. Witnesses might also include delivery personnel or service workers who were in the area.

- Set Up Interviews: Approach potential witnesses respectfully and explain the situation. Schedule a convenient time to talk, making sure they're comfortable and willing to share their experiences.

- Record Detailed Accounts: During the interview, ask open-ended questions to gather extensive details. Document their observations, focusing on the time, nature, and extent of the wind damage.

- Verify Contact Information: Collect the witness's full name, phone number, and address. This guarantees we can reach out for further clarification if needed and provides credibility to their statements.

Organizing Documentation for Claims

To ensure our wind damage claim is processed efficiently, it's crucial to organize all collected documentation properly. Proper document organization is essential to have quick access to information during the claim process.

Start by categorizing documents into sections such as photos, repair estimates, receipts, and witness statements. Clearly label each section to make it simple to locate specific items when needed.

When preparing for claim submission, create a checklist to confirm all essential documents are included. This guarantees that critical information is not overlooked, which could delay insurance approval.

Digital copies should be stored securely, preferably in the cloud, to prevent loss and enable easy sharing with the insurance provider.

It's helpful to keep a log detailing all interactions with the insurance company, including dates, names, and summaries of discussions. This log will be invaluable if disputes arise or if past communications need to be referenced.

Frequently Asked Questions

Should I Contact My Insurance Company Before or After Documenting Wind Damage?

Contacting the insurance company first clarifies the insurance timeline and claim process. We should swiftly start our damage assessment to guarantee complete insurance coverage. By doing this, we safeguard our freedom to handle repairs promptly.

Are There Specific Documents I Need to File a Wind Damage Claim?

To file a wind damage claim, we'll need specific documents like photos, repair estimates, and receipts. This required evidence helps streamline the claim process, ensuring we get the compensation we deserve without unnecessary delays.

How Soon Should I Report Wind Damage to My Insurance Company?

Time waits for no one! We must report wind damage to our insurance company immediately. Timely reporting guarantees our insurance coverage remains intact and maintains our eligibility for claims. Prompt action is essential for maximum benefits.

Can I Hire a Professional to Help With the Documentation Process?

Yes, we can hire professional assistance for the documentation process. Expert guidance guarantees our insurance claim is thorough and accurate. This empowers us to focus on recovery, knowing our claim is handled with precision and expertise.

What Types of Wind Damage Are Typically Covered by Homeowners Insurance?

When the winds of change blow, we need to know what's covered. Typically, homeowners insurance covers roof and structural damage but has wind damage exclusions and insurance coverage restrictions for items like fences, sheds, and personal property.